In less than an hour, you can make your own free budget template in Google Sheets. You’ll find out more about Making Budget On Google Sheets An Easy Guide to your money and how you think about it.

There are a lot of tools out there that can help you make a budget, keep track of your bank accounts, and set savings goals.

But before you buy expensive tools to help you manage your money, you might be better off just making a budget in Google Sheets.

In less than an hour, you can make your own free budget template in Google Sheets. And by making your own budget, you’ll learn more about your money and how you think about it.

Making Budget On Google Sheets An Easy Guide

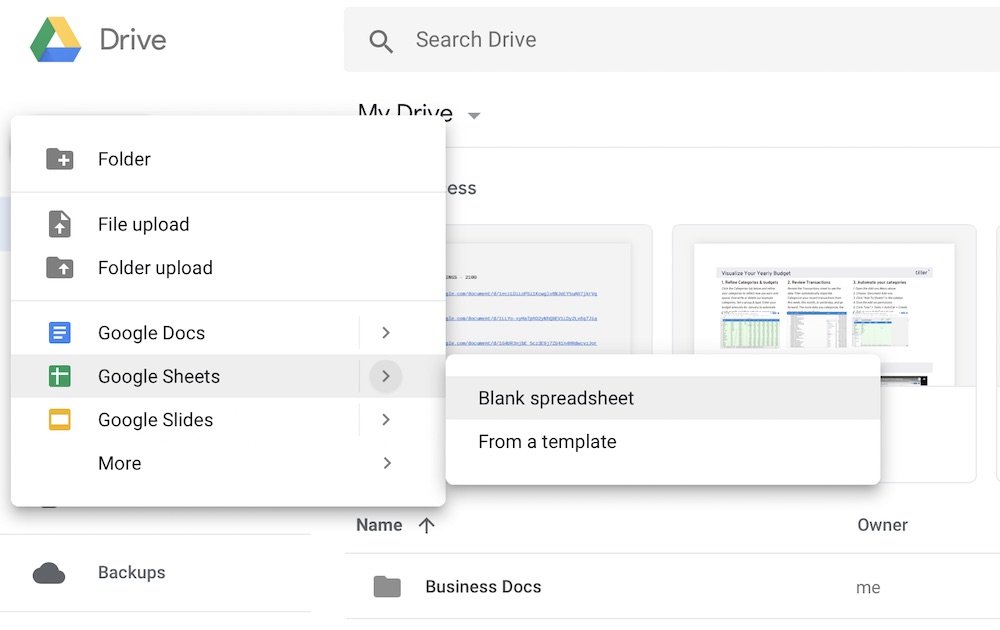

Step 1: Open a Google Sheet

Go to your account on Google Drive. Click “New” and “Google Sheet” on the left sidebar.

Step 2: Create Income and Expense Categories

Categories are what hold a budget together. No number of categories is “right.” But you need enough categories to track all of your income and spending without making things too complicated.

If you find that being more specific helps you keep a better handle on Making Budget On Google Sheets An Easy Guide for your money, you might want to add subcategories to track certain expenses more closely.

This is especially helpful if you’re trying to cut costs in a certain area of your finances.

Read more: Personal Injury Attorney San Fransisco Dolan Law

Step 3: Decide What Budget Period to Use

You may want to budget every day, every week, every two weeks, every month, or every year. How you choose a period may depend on:

- Pay frequency

- how closely do you want to keep an eye on your money

- How often do you want to change your budget spreadsheet

You can also use more than one budget period at the same time. In fact, most budget apps and software keep track of money coming in and going out by month. Then, they take the budget and stretch it out to a whole year.

- No matter how long the budget is, you’ll need to make three columns:

- A column for your planned income and expenses

- A column for real money coming in and going out.

- A column that shows the difference between the two, so you can see your progress in full.

Step 4: Use simple formulas to minimize your time commitment.

Adding up cells by hand takes time, but formulas in Google Sheets make it easy.

The difference between your planned and actual income and expenses can be found by subtracting the amount in the “actual” cell from the amount in the “planned” cell.

You can also use the SUM formula to add up all of Making Budget On Google Sheets An Easy Guide to your income and expenses in a vertical line.

Step 5: Input your budget numbers.

Setting financial goals is all there is to make a budget. Your income puts a hard cap on how much you can spend. But you can choose how to spend your money as long as you don’t go over your budget.

Your past financial information is a great place to start when making a budget. Look at your bank records from the last few months to see where your money is really going.

Step 6: Update your budget.

Make sure to add all of your real transactions to your budget spreadsheet on a regular basis as your chosen budget period goes on. You can keep track of your progress this way.

You might have to change your budget to account for unexpected costs or income. Budgeting means keeping track of the money that comes into and leaves your life.

Don’t worry if your actual income and expenses are different from what you had planned. Your budget will be more accurate the more you use it.

It doesn’t have to be hard to make a budget from scratch. To do a thorough financial check-in, you don’t need a complicated spreadsheet with advanced formulas with Making Budget On Google Sheets An Easy Guide.

It doesn’t have to be hard to make a budget from scratch. To do a thorough financial check-in, you don’t need a complicated spreadsheet with advanced formulas.

But if you know how to use spreadsheets, you might want to add more features to your budget spreadsheet to make it more useful and visually appealing.

Conditional Formatting

Conditional formatting is a great way to see how your actual expenses compare to what you had planned.

- Right-click on the cell you want to change and choose “Conditional Formatting.”

- Start the process.

- Pick what you want to happen when the condition is met.

- Now, instead of looking at each number in your budget one by one, you can quickly see which categories are over or under budget.

Charts and Graphs

You can also add graphs and charts to show how your spending is changing over time with Making Budget On Google Sheets An Easy Guide.

- Choose “Insert” and “Chart” from the menu bar.

- On the right side of your screen, a sidebar will show up. It gives you the option to:

- What your chart shows

- What kind of graph or chart it is

- Several things about the chart or graph

FAQs

Do Google Sheets have a template for making a budget?

Making a Budget on Google Sheets: A Step-by-Step Guide

The monthly budget is important for personal finances. One option is to use a Google Sheet template. It lists all of your monthly expenses, your monthly income, the money you save, and your balance at the beginning and end of the month.

Does Google have a tool for making a budget?

With this free add-on, you can use Google Sheets to make a budget. Set up categories and subcategories for your income and expenses, and then enter your transactions. A tab called “Expenses” will let you look at your monthly spending by category and compare it to your budget.

Should I use Google Sheets to make a budget?

A budget is a useful financial tool. Whether you’re making a budget for a large company or a small family, a budget can help you save for future goals or get through hard times. Google Sheets is a great way to make a budget because you can change it to fit your specific financial needs.