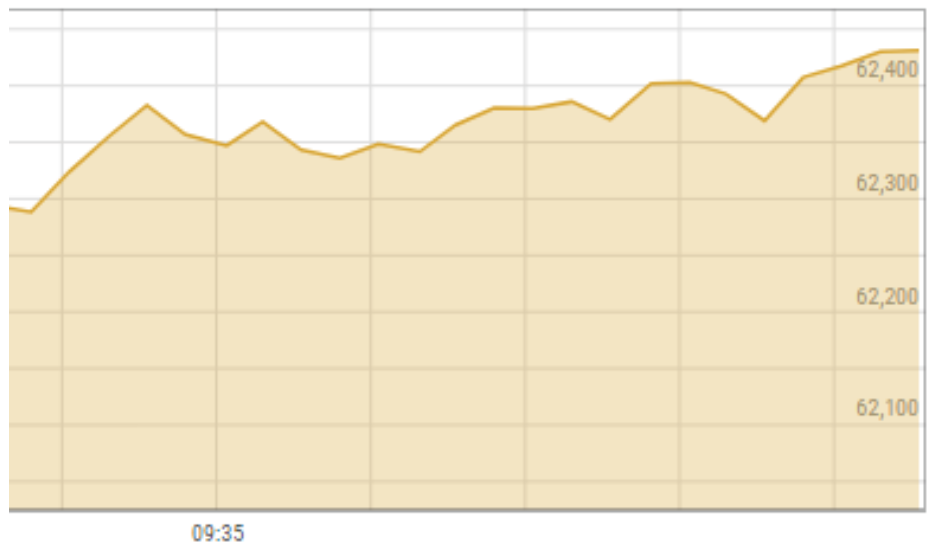

On Monday, amidst increasing clarity regarding macroeconomic factors, the benchmark index of the Pakistan Stock Exchange (PSX) surpassed the 62,000 mark, continuing its favorable trend from the previous sessions.

A rally of 800 points propels the PSX past the record 62000 mark. The KSE-100 index closed at 62,493.05 points, an increase of 801.80 points, or 1.3%, from its previous close of 61,691.25, as reported by the PSX website.

Analysts attribute the consistent upward trend in the benchmark of representative shares to improved economic indicators in the country, such as the State Bank of Pakistan’s foreign exchange reserves increasing by $77 million to $7.2 billion for the week ending November 24. These gains also include the highly anticipated reduction in the policy rate moving forward.

Read more: Reduced Stocks And Robust China Data Propel Copper To A Three-Month High.

Faran Rizvi of JS Global stated to Dawn.com today, “Market participants have a tendency to act prematurely in anticipation of future events, perceiving macroeconomic developments.”

He further stated that it was anticipated that the bullish trajectory would persist “as macroeconomic factors gained considerable clarity preceding the election date.”

Rizvi additionally observed that foreign investors “exhibited increased interest in Pakistani stocks, as evidenced by the largest infusion of capital in November—$34.5 million—the highest level since January 2018 and the highest level in six years.”

In the interim, Raza Jafri, head of equity for Intermarket Securities, reported that a respectable proportion of market participants were expecting an interest rate cut, which is expected to be disclosed subsequent to the monetary policy meeting on December 12.

Nevertheless, he emphasized that the prevailing opinion on the market was that interest rates would remain unchanged. Jafri further stated that the majority of PSX activity was documented in “cheap energy names,” given the uncertain nature of when monetary easing will occur.

Analysts at Arif Habib Limited predicted that the bullish momentum would persist well into 2024, stating that “substantial domestic liquidity, robust earnings growth, and relatively steady economic growth” would enable the benchmark index KSE-100 to generate an alluring total return of 32%.

The projections for 2024, according to a report published today, indicated a 24 percent decline in inflation and the beginning of the monetary easing cycle in January. Additionally, it expected the main policy rate to attain 15% by December 24th.

Despite a noteworthy 45 percent return, the analysts cautioned that the index continues to be substantially undervalued from a variety of valuation perspectives.